Top 5

1) Bills Gates

Bill Gates was the richest man and that makes his move above the

Mexican investor called Carlos slim that was the richest person before. He

added $15.8 billion that give him a $ 78.5 billion in fortune. In Microsoft

companies, he holds 4.3% share and the share jumped to 40% then. He make

investment in Canadian National Railway and the investment was rose as 34%. He

also gains 45% in Ecolab investment. Bill and Melinda Foundation Trust held on

to 22 stocks that valued nearly $20 billion. The five investments that Bill

Gates had the most is Berkshire Hathaway Inc (BRK.B), Coca-Cola Co (KO),

MacDonald’s Corporation (MCD), Caterpillar Inc. (CAT), and Canadian National

Railway Co (CNI).

For more info: http://www.gurufocus.com/news/242051/bill-gates--wealthiest-person-and-largest-earner-of-2013

2) Steve Jobs

The American Inventor and Business magnate, Steve Jobs

had a net worth of $10.2 Billion dollars. Steve Jobs also is a co-founder and

executive officer of Apple computer. Previously, Jobs was served as the Chief

executive of Pixar Animation studios. In the 1980s, Apple II series, one of the

first commercially successful lines of personal computers has been designed by

Jobs, along with Apple co-founder Steve Wozniak, Mike Markkula Ronald Wayne,

and others. Every year, Jobs insanely creative

Apple cheif transform

multibillion-dollar industry. Firstly, by personal computers with Apple

II,Mcintosh. Next the film with Pixar:music (iTunes), mobile (iPhone), Now Ipad

is treated as messiah tablet, saviour for publishing industry. Nowadays Apple

still sells computers, but much of the revue comes from music distribution and

hand-held devices.

For more info: http://www.therichest.com/celebnetworth/celebrity-business/tech-billionaire/steve-jobs-net-worth/

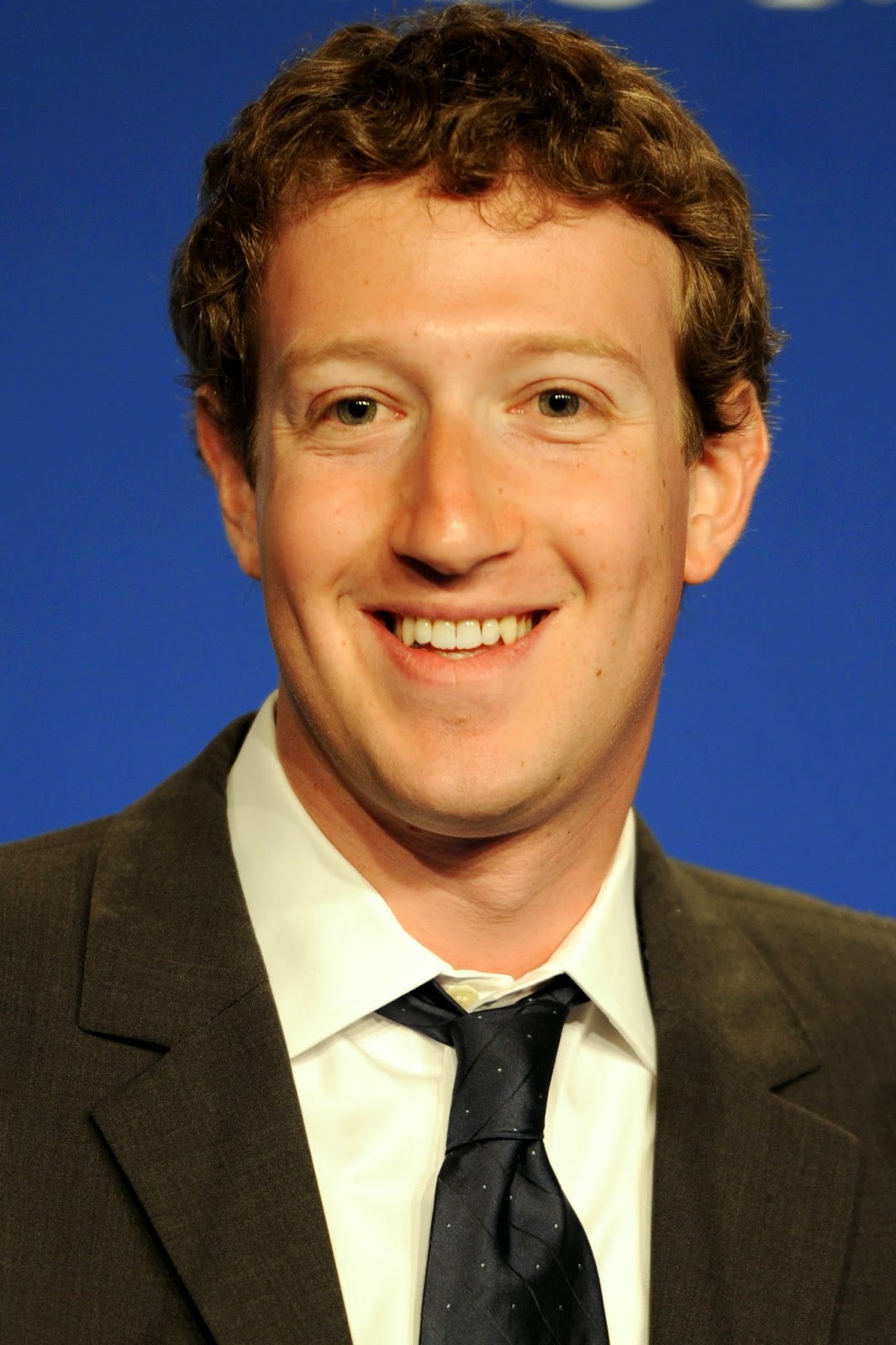

3) Mark Zuckerberg

Facebook announce that their total revenue for the end of 2013 is

US$7.87 billion and their annual profit calculated in 2013 was US$1.5 billion.

Majority of Facebook's revenue gain from advertising. Facebook selling banner

advertising to other company by system call click through (CTR)

through Facebook timeline. A main part of Facebook's aim is that it has tons of

information about its users that it can easily target ads to those who response

to the content. By using this way, Facebook gain huge amount of revenue each

year through this strategy. For more info: http://en.wikipedia.org/wiki/Facebook

4) Charles E. Culpeper

Coca-cola Company is a very large company in the baverage industry. At the

end of 2013 Coca- cola revenue was US

$46854 million. The revenue was slightly decrease as compare to year 2012 which

is US $48017 million. How ever the gross profits different was only US $531

million. Eventhough there are slightly decrease in revenue and profits,

Coca-cola still a leader in the baverage industry.

5th

Place: Gordon Moore

Intel Corporation has shown a relatively steady growth and

encouraging throughout the last few decades. For example, Intel's revenue per

share increased from $ 4.55 at the end of 2003 to $ 10.34 at the end of 2012,

with an average growth rate of 8.2% over the past 10 years. Moreover, with a

gross margin of 59% and operating margin of 23:44%, Intel Corporation is seen

able to control costs and expenses to better than 91% of its competitors. Intel

Corporation also performed relatively well in dividend yield over the years.

Current dividend yield for Intel is 3.98%. This value is greater than 94% of

companies in the semiconductor industry. Fore more info: http://www.gurufocus.com/news/228023/intel-corporation-intc--stock-analysis

BOTTOM 2

49) : John Cadbury

The annual revenue of Cadbury Company approximately $50 billion. The

company achieve revenue growth of 20% per year, increase earning by 15% annualy

and increase dividents per share by 7% per year. In 1847 John Cadbury

became a partner with his brother Benjamin and the company became known as

"Cadbury Brothers". The company went into decline in the late 1850s.

John Cadbury's sons Richard and George took over the business in 1861. At the

time of the takeover, the business was in rapid decline, the number of

employees had reduced from 20 to 11, and the company was losing money.

50) Fred Smith

The winter

ambience gave a bad impact on FedEx parcel delivery when the revenue and

adjusted earning only increased 3 and 8.8 % but still below the analyst

estimations. Moreover, sometimes, uncommonly severe winter storms impeded

delivery and due to decreased in shipping volume and increased in operational

costs, FedEx estimated that the company has lost roughly $ 125 million.

Besides, FedEx has bad financial report where the company's net income has

fallen from $ 185 million in 1989 to just $ 6 million in 1991.

No comments:

Post a Comment